We provide FREE debt advice

Our mission is to help our clients take control of their financial situation, find sustainable solutions to a debt-free future, and improve their wellbeing. We are EMMA (East Midlands Money Advice Partnership) – a group of voluntary sector advice agencies who provide advice on debt to people in the East Midlands.

The funding to carry out our mission is provided by the Money and Pensions Service (MaPS).

The advice we provide to our clients is FREE, impartial, non-judgmental and it is quality-assured. The work of our advisers is regularly assessed to ensure it is of high standard. 98%* of our clients are satisfied with the service they have received.

In the last 3 years, we have helped over 43,000 people across the East Midlands. We understand the challenges our clients face and are committed to be available to all and accessible by all. We offer appointments in person, on the phone, via webchat and emails. We work hard to ensure we meet our clients needs and can arrange language interpretation services for our appointments. Our advice agencies have offices across the East Midlands, and we attend regular outreaches to ensure we are close to clients in need.

If you have any questions on our services or would like to get in touch with our advisers, you can visit our Service Locations and Contact Us pages.

*Data provided by MaPS on Q4 2022/23 satisfaction rates of EMMA clients, who took part in the survey.

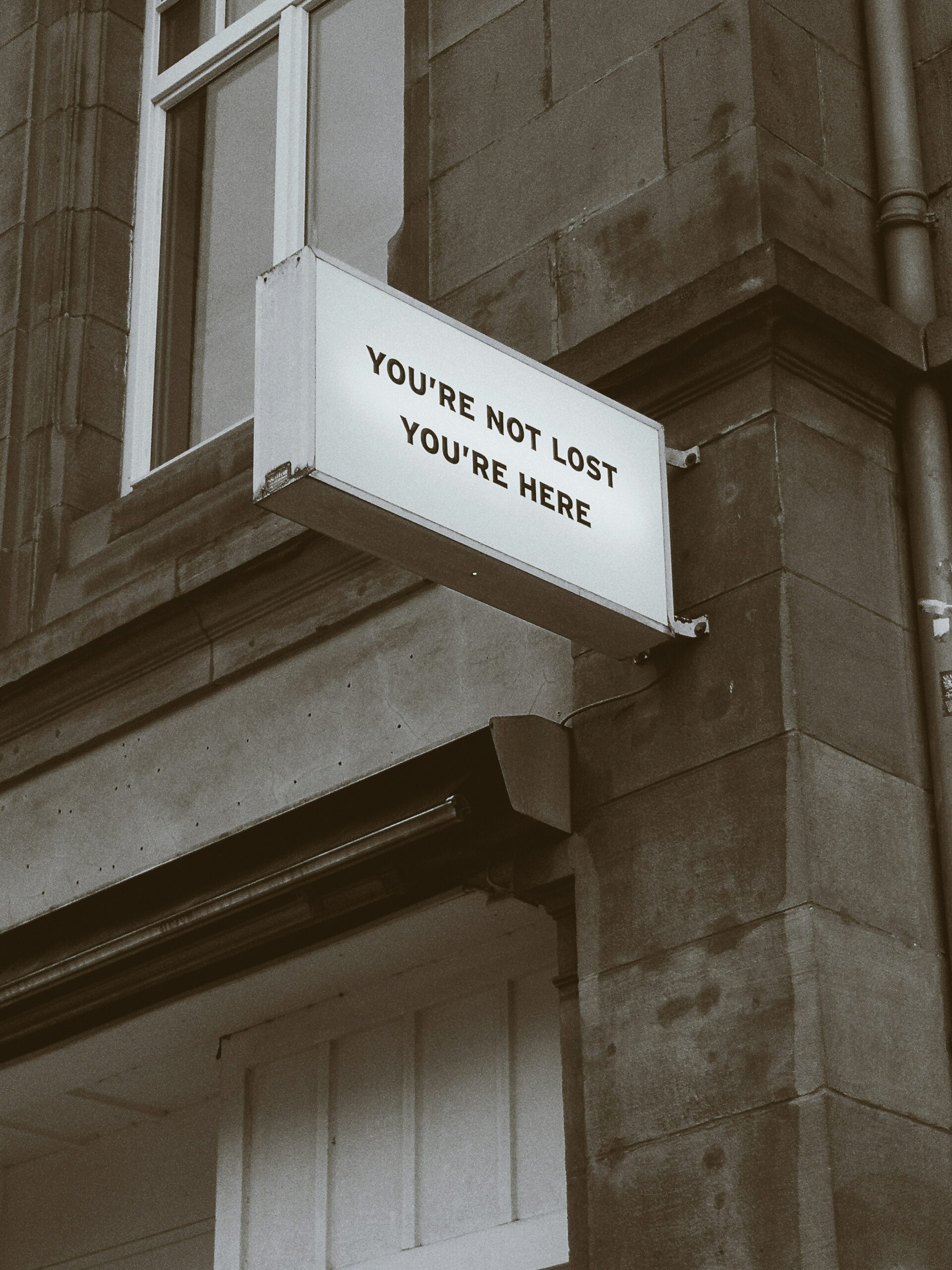

We are here to help

The first step to resolving your debt issues is to get in touch with an adviser. Visit our Service locations or send us a message to Get Help.